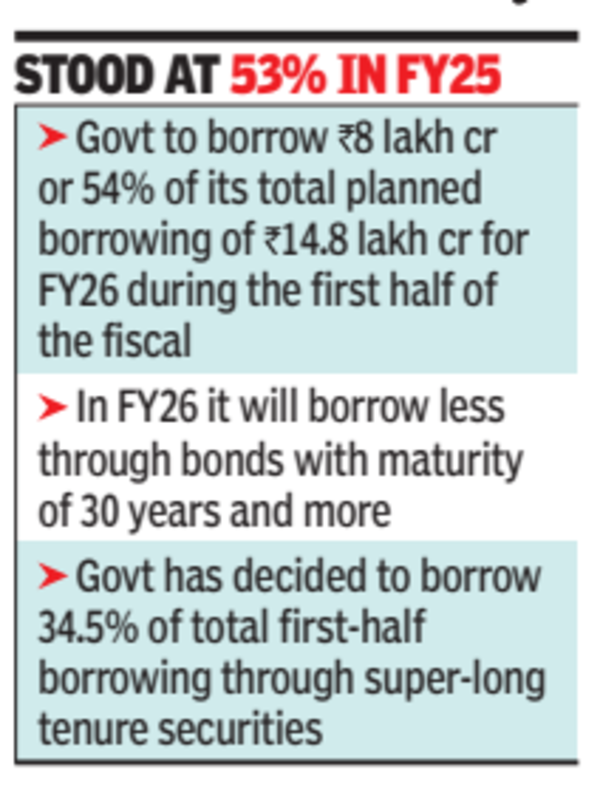

Mumbai: Govt on Thursday said it will borrow Rs 8 lakh crore or 54% of its total planned borrowing of Rs 14.8 lakh crore for FY26 during the first half of the fiscal. It refrained from front-loading the borrowing programme to avoid any upward pressure on rates when the RBI is infusing a record level of liquidity into the system.

Govt also said that in FY26 it will borrow less through bonds with maturity of 30 years and more (super long maturity) since the market had communicated to them about muted demand for such papers.

“Recent growth moderation needed policy support for at least the next 6-9 months. Hence, in continuation of the ongoing policy measures by govt (sticking to fiscal consolidation without compromising quality of expenditure) and RBI (initiation of monetary easing with sizeable liquidity infusion), front-loading of the borrowing programme has been avoided. This will deny any undue pressure on market interest rates,” said Ram Kamal Samanta, senior VP – investments, Star Union Dai-ichi Life Insurance.

Of the total gross borrowing programme, govt is planning to mobilise 54% in the first half, as compared to 53% in FY25, 58% in FY24 and 59% in FY23. Additionally, govt has decided to borrow 34.5% of total first-half borrowing through super-long tenure securities as compared to 37% during the first half of FY25. The decision comes in the backdrop of widening of yield spreads of super long gilts over the benchmark 10-year gilts from 20 basis points (100bps = 1 percentage point) during Sept 2024 to as high as 47 basis points during late February 2025.This indicates lesser appetite from long term investors amid recent growth moderation, bond market players said.