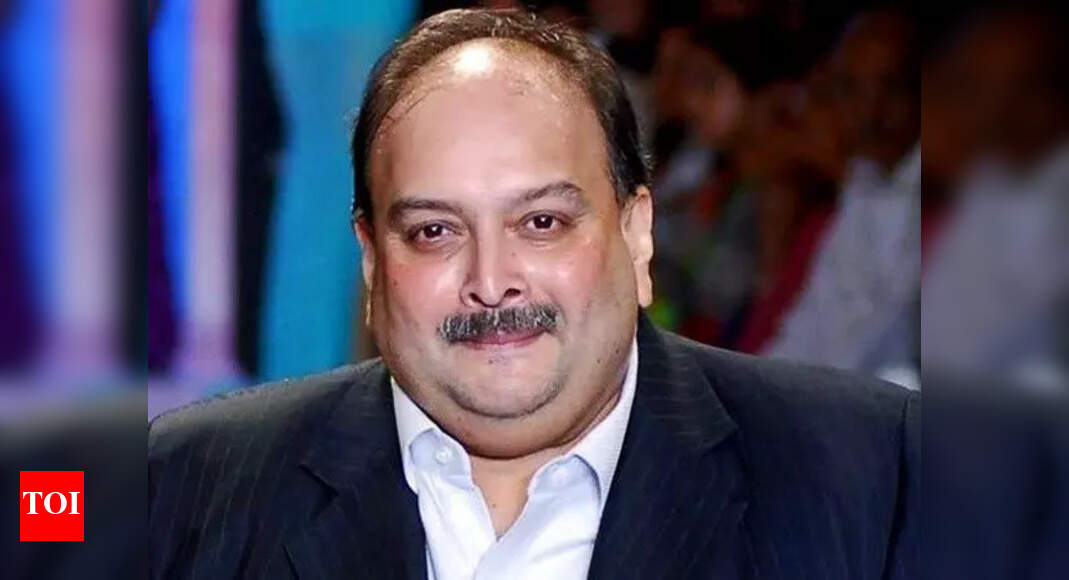

Mumbai: Bank-appointed liquidators recently issued a sale notice for auctioning of properties belonging to diamond merchant Mehul Choksi following clearance from the Enforcement Directorate, which gave an NOC for restitution of attached assets worth Rs 150 crore. The assets included in the sale notice were mainly gems and jewellery, according to their actual cost fixed by the valuer.

There are four separate bank fraud CBI FIRs against Choksi, based on which the ED also booked him in a separate money laundering case and attached his and his associates’ assets worth Rs 2,566 crore, most of which were attached in the first case registered in 2018.

Sources said that after Choksi’s arrest in Belgium, the ED’s pending application from 2018 to declare Choksi a fugitive economic offender may advance more rapidly, which will help them in the restitution of the remaining attached properties. Choksi has been evading his return citing ill-health while fighting a legal case in court. In 2019, the ED offered to arrange an air ambulance with medical staff for his safe transport. Choksi previously contested extradition citing health concerns.

The ED’s investigation covered searches at 136 locations across India, seizing valuables worth Rs 597.75 crore from Gitanjali Group. The agency attached assets valued at Rs 1,968.15 crore, including properties in India and abroad, vehicles, bank accounts, factory premises, company shares and jewellery. The total attachments reached Rs 2,565.9 crore, resulting in three prosecution complaints.

In addition to the PNB case, other books too came forward to file cases after completing legal formalities. The CBI subsequently registered four additional FIRs against Choksi’s companies, prompting separate ED money laundering investigations. Last year, the ED collaborated with PNB and ICICI Bank to facilitate asset restitution and monetisation. The court permitted monetisation of properties. The handover process commenced with properties exceeding Rs 125 crore transferred to the liquidator, including Mumbai flats and two SEEPZ factories. Six properties at Kheni Tower, Santacruz, valued at approximately Rs 27 crore, and two SEEPZ properties worth Rs 98.03 crore were restored to the liquidator of Gitanjali Gems Ltd. The remaining assets continue to get transferred to the liquidator/banks according to court directives. Following the banks’ joint application, court authorised liquidators that sale proceeds shall be deposited as fixed deposits with ICICI Bank and PNB on the court’s name after deducting all associated costs and expenses incurred for carrying out valuation/auction.