WASHINGTON: Facebook parent Meta Platforms bought up nascent rivals Instagram and WhatsApp after its attempts to compete had failed, an attorney for the US Federal Trade Commission said at the beginning of a high-stakes trial in Washington on Monday, where US antitrust enforcers seek to unwind the deals.

FTC attorney Daniel Matheson said that the unlawful strategy “established entry barriers that for more than a decade protected Meta’s dominance”. “Consumers do not have reasonable alternatives they can turn to,” he said.

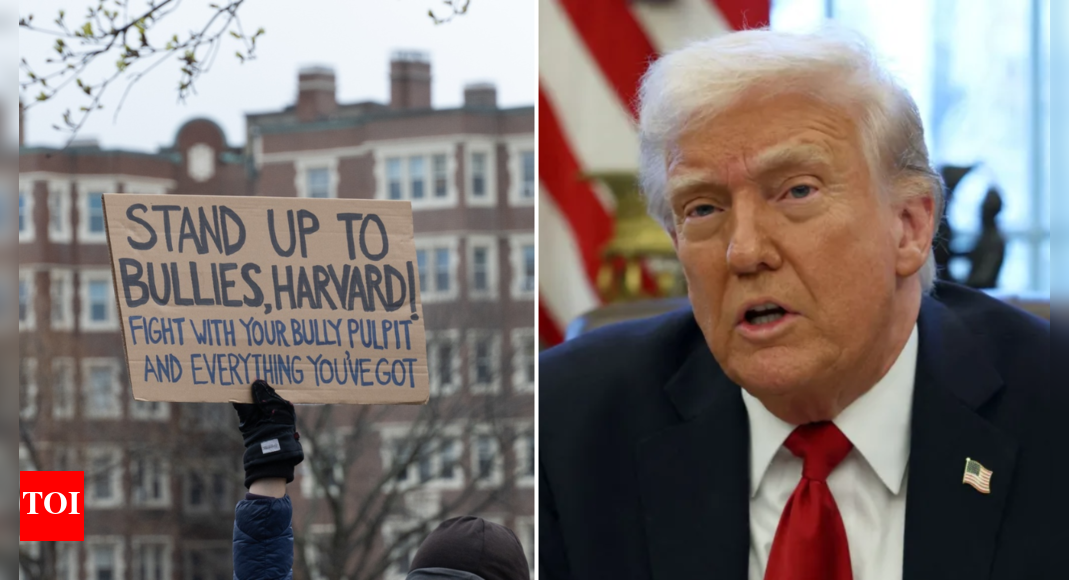

The case, filed during President Trump’s first term, claims Meta bought the companies a decade ago to eliminate competition among social media platforms where users connect with friends and family. The FTC seeks to force Meta to restructure or sell parts of its business, including Instagram and WhatsApp. The case poses an existential threat to Meta, which by some estimates earns about half of its US advertising revenue from Instagram, while testing the new Trump administration’s promises to take on Big Tech.

Meta has been making regular overtures to Trump since his election, nixing content moderation policies Republicans said amounted to censorship and donating $1 million to Trump’s inauguration. CEO Mark Zuckerberg has also visited White House multiple times in recent weeks.

Meta chief legal officer Jennifer Newstead called the case weak and a deterrent to tech investment. “It’s absurd that the FTC is trying to break up a great American company at the same time the administration is trying to save Chinese-owned TikTok,” she wrote in a blog post on Sunday.

Zuckerberg is expected to take stand and face questioning. The trial could stretch into July. If the FTC wins, it would have to prove at a second trial that measures such as forcing Meta to sell Instagram or WhatsApp would restore competition. Research firm Emarketer forecast in Dec that Instagram would generate $37.13 billion this year, a little over half of Meta’s US ad revenue. WhatsApp to date has contributed only a sliver to Meta’s total revenue, but it is the company’s biggest app in terms of daily users and ramping up efforts to earn money off tools like chatbots.