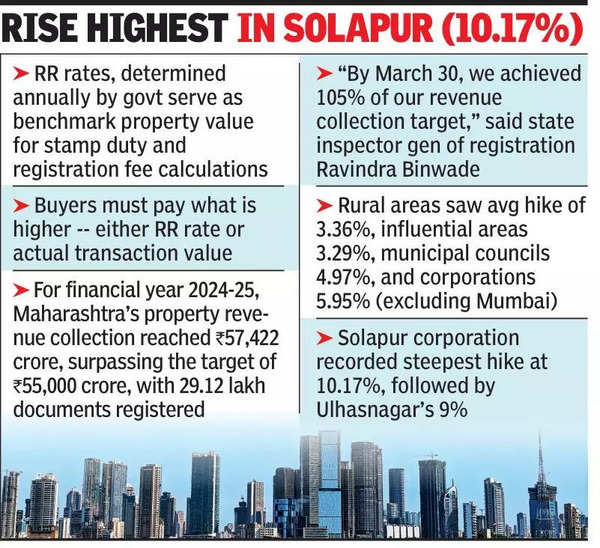

MUMBAI/PUNE: After a gap of three years, the state govt increased the Ready Reckoner (RR) rates – benchmark property value for stamp duty & registration fee calculations- by an average of 3.39% in Mumbai Monday.

Across the state, the increase is an average of 3.89%, announced the state revenue dept. Apart from stamp duty taxation as per the RR rate, the 1% Metro cess in Mumbai will continue.

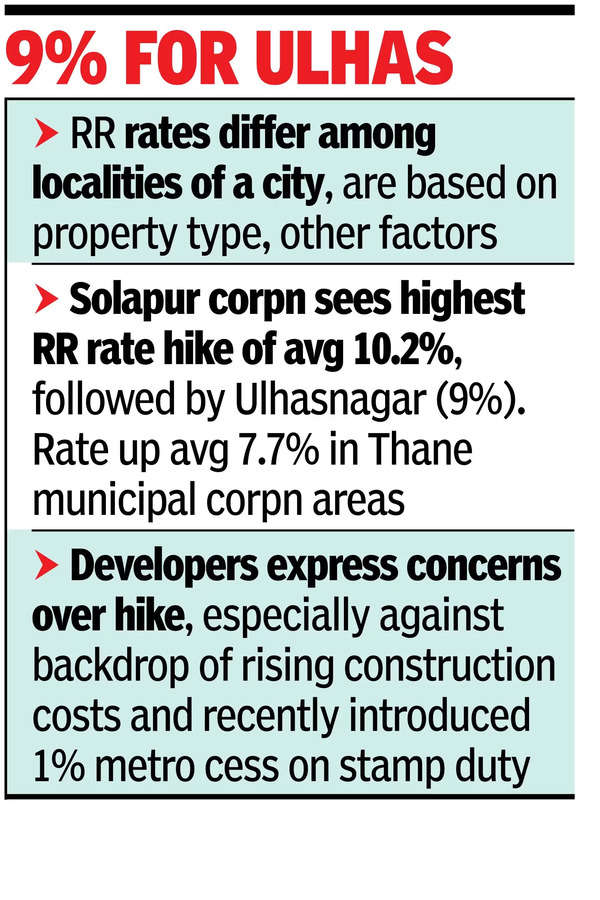

In 2022-23, the RR rate- was hiked by 2.34% on average. The RR rate increases for various municipal corporations in MMR range from a high of 9% in Ulhasnagar, followed by 7.72% for Thane Municipal Corporation to 2.5% for Bhiwandi-Nizampur Municipal Corporation.

Officials said they assess the market rates in various zones and referred to them while preparing the RR rates. However, a property valuation expert said that “while the 7.72% average increase in RR rate in Thane may seem high, it is actually not because the flat rates are nearly double the RR rates”.

4.97% RR rate hike in Panvel driven by airport construction

Officials said they constantly survey the market to assess the market rates in various zones, which are referred to while preparing the RR rates for the next financial year. In the case of Panvel Municipal Corporation, the construction of the airport, a major infrastructure project, influenced the RR rate increase, which is 4.97%, and for Navi Mumbai, it is 6.75%. While the RR rate hike for Mira Bhayandar is 6.26%, it is 4.5% for Vasai-Virar and 5.84% for Kalyan-Dombivli.

Sunit Gupta, a property valuation expert, said Mumbai has 700 zones, and it would take another couple of days to know what the hike is in each of these zones. “The average increase in Mumbai is 3.39%. It could be zero in some zones, 5% or 10% in others. This entire exercise is futile. Our demand to govt has been that it must rationalise the RR rates in areas where it exceeds even market rate for the flat,” he said.

Gupta said recently the Supreme Court in a judgement directed that RR rates must be drawn up scientifically and must be as near as possible to the market rates. “While the 7.72% average increase in RR rate in Thane may seem high, it is actually not because the flat rates are nearly double the RR rates. The Ulhasnagar RR rate hike is surprising considering it has very poor infrastructure and a large number of illegal buildings,” he said.

State Inspector General of Registration Ravindra Binwade said municipal cor poration areas witnessed the highest hike at 5.95%. “Excluding Mumbai, the state’s average RR rate hike stands at 4.39%. Some areas have seen reductions, depending on transaction trends. This year, we relied on traditional assessment methods, but from next year, GIS mapping technology will be used for a more scientific approach,” Binwade added.

Rural areas saw an average hike of 3.36%, influential areas 3.29%, municipal co uncils 4.97%, and municipal corporations 5.95% (excluding Mumbai). Solapur municipal corporation recorded the steepest hike at 10.17%, followed by Ulhasnagar’s 9% and Amravati at 8.03%. Pune city’s RR rates rose by 4.16%.

Developers and real estate industry representatives expressed concerns over the hike, especially in the backdrop of rising construction costs and the recently introduced 1% metro cess on stamp duty. They argued that the increase will adversely affect property sales and development costs.

Shantilal Kataria, a governing council member of CREDAI, criticised the traditional assessment method used in the revision. “A scientific, data-driven approach is necessary. While average increase appears moderate, rural areas undergoing rapid development may witness steep hikes, impacting planned township and infrastructure projects,” he stated. For homebuyers, Ramesh Prabhu, a consumer rights advocate, said the metro cess combined with the RR rate hike could dampen property transactions.